In my last post I wrote about my 2021 reading list because it was an easy way to get started with writing again, and is a common theme for bloggers and influencers or even just folks, like me. Here’s another popular blog post subject I see people writing about this time of year: predictions for the coming year, and beyond.

This topic is a favorite of mine. I used to do this every year, before I started this blog, and share my predictions among a small handful of friends, who would do the same with their own forecasts. Forecasting the future was a natural thing for me to enjoy, since a lot of my work as a professional involved business planning and forecasting, trend-watching, and being alert for shifts and changes.

With that said, predicting the future is always humbling, and when I go back and look at my previous forecasts, I can see that I have no greater insight than anyone else once I am predicting things outside my control or influence. For example, as I look back on some of my predictions, I see that in 2016 I predicted Hillary Clinton to win the presidential election (wrong), but that I also predicted this would little change the current course of regulatory capture and political graft (right). In 2017, which is the last year I had written my forecast, my predicted S&P 500 closing level was 2,500, which would have been a 10% up year for the index, and the actual closing level was about 2,684; directionally correct. On GDP I did better, predicting a 2.2% annual real GDP versus 2.3% actual, based on the 3rd estimate published by BEA in March of ‘18. I had predicted Bitcoin would close 2017 at about $2,000 (it was trading in the $900 range at the time I was writing). It finished 2017 at about $14,000.

A few really interesting things pop out to me from my 2017 predictions. At that time, the annexation of Crimea by Russia was still fresh in the political consciousness, and I had predicted that this possession would get normalized, leading to a more aggressive Russian posture in Ukraine. As happens with me often, it looks like I wasn’t wrong, just early.

In 2017 I was still working actively in the mortgage banking industry. I had guessed that the big government agencies that own and control that industry, Fannie Mae and Freddie Mac (don’t make fun of me, that is really what they call them), would make meaningful moves away from the Fair Isaac credit reporting score (FICO score) as a primary qualifying tool for loan approvals. Not sure I got that right at all. My other big industry prediction was that the exciting, emergent technology upon which #Bitcoin is built, blockchain technology, would threaten title insurance as an industry and render that business obsolete. Once again, it appears I was right, but really, really early (hint: a blockchain called #Ravencoin is the answer)

So consider that preamble my disclaimer: I am not responsible for anyone taking any action of any kind, financial or otherwise, based upon my predictions. Now, what will happen in 2022? Here is what I am 100% sure of (jk, see disclaimer above):

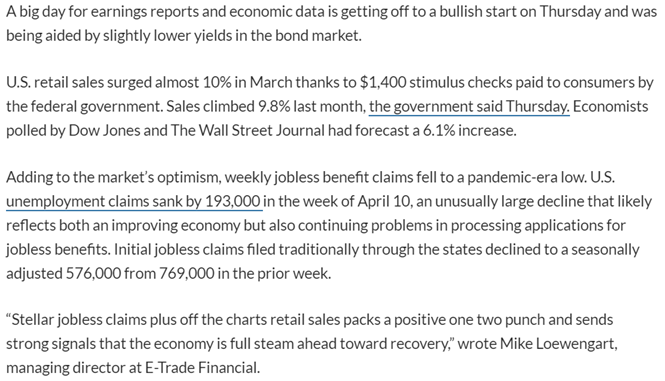

Broadly, I think we will see that stagflation is our destination. We may not reach the fullest expression of this stagflationary cycle in 2022, but this word will start to take the place of ‘inflation’ on the lips of the pundits and talking heads as we see persistently high, or even rising consumer price levels against a backdrop of low (and probably falling) interest rates, slowing economic growth, and missing real wage growth. Three big factors that will exacerbate our circumstances are:

- The ongoing supply chain logistical problems originating out of the response to the COVID-19 flu, and the attendant production, delivery and inventory management changes underway to insulate against such disruptions in the future. Change takes time, and in this case, it will take investment, too. The slower the investments are in coming, the more time this disruption will take to resolve.

- Geopolitical tensions. There is a toxic combination of territorial disputes (mostly stemming from the events of the 20th century) and a legitimate loss of faith in the United States as a balanced actor in world affairs. It appears as though we may no longer be the respected authority offering thoughtful solutions backed by a big stick, and instead are perceived more as a blindfolded child, swinging a big stick.

- Political graft and fecklessness. There are no adults in this room. Just thugs and pickpockets, coached in lying, and the human remora swimming around them. As near as I can tell, this is a global problem, not just domestic.

What will it look like specifically? I take a lot of my queues from a handful of really smart people. These are the folks I follow whose arguments and information I find most credible. My preferred arguments come from Jeff Snider of Alhambra Investments, Tracy Shuchart of HedgeFundTelemetry.com and David Rosenberg of Rosenbergresearch.com. I try to ingest as much of their freely published content as I can, along with a pretty good clutch of others.

Cribbing mostly off these peoples’ greatness, I am looking for US ten year treasury yields near 1% by the end of 2022, with real yields remaining strongly negative. I believe this is the intended policy outcome, and the only way forward for the administration (any administration) and the Federal Reserve. Despite and in contradiction with my expectations about low interest rates, I expect the dollar to remain stubbornly strong. Maybe not DXY to 106 strong, but also not DXY < 89 weak. I won’t be surprised to see the dollar remain between 96 and 102, and I expect this range will be sufficiently frustrating to policy-makers, and difficult for emerging markets. It should go without saying that I expect all talk of a Fed rate increase to always remain just talk. I just don’t see it happening. If the Fed does hike, I will view it as evidence of an intentional ‘controlled destruction’, where the ‘controlled’ part is far from certain.

In a similarly paradoxical way, I expect oil to reach $130-$135. It could take into the first half of 2023 to get there, but I think probably before the end of the year. This despite the strong dollar and what I expect will be a slowing or even recessionary economy.

I expect residential housing to remain strong, but with more normal levels of price increases. I anticipate this will be accompanied by a large increase in multi-family projects coming to market, helping to contain inflation in rents (contain, not eliminate or reverse).

I don’t have any new reason to think so, but I have long thought gold and silver should catch a strong bid, and maybe this will be their year. I hope so!

And while I am hoping, I genuinely thought bitcoin would hit $100K before the end of last year. I am still a believer in the fundamental relevance of the stock-to-flow model, which calls for an average bitcoin price of $100K for this entire halving epoch. So at this point, I am kind of expecting a pretty wild spike to bring that average up. We are about half way through this cycle, so prices significantly above $100K at times during the next two years are called for, if that model is to be validated.

Moving from macro to politics, I think what everyone else thinks about the midterms: the Democrats are getting swept. Just absolutely destroyed. If I am wrong on this, so are a lot of other people. That said, I don’t expect a bunch of new Republicans in congress to do anything to ameliorate the corruption and fecklessness I mentioned above.

One prediction I have been making since 2020 is that Joe Biden will not finish his term. Again, I believe probably a lot of people have been thinking this from the start, so maybe this is not a big prediction, but I think we see President Harris at the wheel, and possibly this year (though year three seems more likely to me). Just this evening I saw Bill Kristol postulate that Harris will be the next Supreme Court nominee, freeing up the Vice Presidency to a Mitt Romney nomination. This is the exact kind of outcome that is hard to foresee, and still likely to happen. I do not discount this as a thesis. I still think it culminates in Joe not finishing the term.

Finally, while I hate to be a pessimist, I am expecting at least one and probably a series of nasty crises this year. There are just too many people in power and too many countries with too many intractable problems. I expect serious drama involving technology, whether it is the much anticipated cyber pandemic or a more overt attack by governments in traditionally liberal democratic countries, like the United States, on individual access and privacy. It is hard not to expect some major escalation of armed conflict around existing tensions, and there are dozens to choose from across the globe, with Russia/Ukraine standing prominently as I write. And I will not be surprised if the newly formed task force on domestic terrorism doesn’t also need a newly formed domestic enemy or crisis to justify itself.

I know. This is not the most cheerful forecast for 2022, the year of the black water tiger. But, whenever one zooms out beyond a few years, or zooms in to see the individual, family, and local community experience instead of looking at the broad, one-year macro view as I have done here, there are millions (billions?) of positive and hopeful things to see and think. I take comfort that these times are transitory (no Fed pun intended). We will get through them, and be better for it on the other side.