Servicing = paying hundreds of dollars per year to have thousands of people at legacy institutions mishandle your personal and transaction data.

Request for Clarification on How to Get Sprayed With the Money Hose

It is about ten minutes after three in the afternoon on Sunday, and I am at the store. Sunday is a day I dedicate to study and learning, and today I have been smarting up on the CARES Act, CA AB 2501, and incidentally reading the MBA letter issued to the Chairman of the Federal Reserve on May 28, 2020 titled “Request for Clarifying Guidance on Independent Mortgage Banks Eligibility Under the Main Street Loan Program”. Let’s take this last one first, since it is the one that finally halted me.

The purpose of the letter is to ask the Fed to clarify restrictions and limitation on participating in the Main Street Lending Program (MSLP) to ensure Independent Mortgage Banks (IMB’s) can participate and get loans to fund their operations. The MSLP is among the many actions taken by congress, the Fed and Treasury to provide liquidity to small businesses. Here is my recap of the letter:

- IMBs need access to operating funds, even though they have large credit facilities for the purpose of financing their mortgage loan purchases. Since these giant facilities can’t be used for operating purposes, generally, the IMBs want access to loans which can be,

- The giant warehouse credit facilities are already lent at multiples much higher than the maximum multiple allowed under the MSLP. The letter seeks to exclude these giant credit facilities so that their remaining leverage ratio will allow them to qualify for more debt,

- The giant credit facilities already encumber all of the company’s assets, and it is warranted that no new lien will hold the same or higher level of security interest. The MSLP requirement of seniority or pari passu renders IMBs ineligible. They would like the government to accept a lower priority so that the IMBs can access the funds,

- Banks and finance companies whose stock and trade is money, and who engage in finance activities, are expressly excluded, except for i.) those that engage primarily in loan servicing and ii.) those that “originate to sell” and sell their loans within 14 days of origination. The letter hopes to eliminate the 14 day requirement, since some loans may take longer than 14 days to sell.

That isn’t exactly how letter-writer Pete Mills put it though. Here is the link to the letter:

https://www.mba.org/advocacy-and-policy/all-letters-and-testimony

I have a few beefs here. The main one though, amid what is otherwise a weak plea for a spray with the Fed’s money hose, is that this exact cohort of businesses are currently experiencing some of the most gob-smacking margins any of them have ever witnessed, and the industry is so far over its capacity with quick, easy-money refinances due to the low, Fed-induced rates their main problem is stuffing their pockets as fast as they can while these dislocations prevail. It is gross.

Independent banks that “originate to sell” in particular should not need the benefits of additional operating capital during these times. They are drowning in a sea of money and asking for a money float. Servicers face a different set of challenges, and I will write more about them here shortly, but they, too are not in a position of financial difficulty at this time, and are in fact enjoying out sized gains and opportunities. Recall that I wrote about the first quarter earnings calls for some of these same businesses a short time ago, here:

I will re-post the quote from CEO of Ocwen (OCN) Glen Massina:

“In terms of the profitability of new servicing, look, margins in the origination environment we’re in today are at levels few of us have seen in our lifetime. It’s a very robust originations market, both from a volume and a margin perspective. In our portfolio retention channel, the economics are such that fundamentally, MSRs — the cash cost of the MSR is zero. So we are — that MSR has come back — coming back to us without necessarily a cash investment. And margins and correspondent lending, again, are as wide as — and our flow channel’s wide as we’ve seen them in quite a long time. So the cash cost, so to speak, of MSR creation is well below the fair value. There’s a number of dislocations in the market, as you might be able to suspect, that’s kind of driving that. But the returns on MSRs today are some of the best we’ve seen.” [emphasis mine]

To translate, he is saying that this industry is currently feasting, and that the market dislocations are a big part of it. Massina repeatedly made the case during the earnings call that the only constraint on (Ocwen’s) growth would be its access to capital to invest. They don’t need this money to continue as a going concern, they want it to further leverage profits.

I get the MBA is in the business of advocating for the advantage of their constituents. I get that everyone who is in business is trying to leave no advantage on the table when it comes to profit, or survival. It is still gross. Maybe if you are an IMB and finding yourself in financial difficulty right now, you should call rwhadvisory LLC and ask for help instead of asking the taxpayer for another bailout. I will accept either equity in your company, or #bitcoin as payment.

Anyway, I set out today to address this CA AB 2501 matter and got side-tracked. I have used my entire time-block to scree on this other letter. Here is the short version of my AB 2501 thoughts:

- Predictably, I am unsympathetic to the servicers

- I find the May 17, 2020 MBA letter to the California assembly to be more weak tea

- I think this bill seems like too much right now, but will turn out to be almost about right as we continue through the pandemic, and I bet multiple, successive actions at the federal level will eventually catch up with what is being proposed in AB 2501

- Whether the bill is good or bad, this bill is reason #47 for why residential mortgage loan servicing is not an asset

I will be back very soon to expound a little more.

Final thought, and it goes pretty good with the mood of my post, check out the latest by @peterMcCormack on his Defiance TV pod:

https://www.defiance.news/podcast/robbing-hood-the-steve-mnuchin-story-part-1-friends-with-benefits

Residential Mortgage Loan Servicing Deep Thoughts #2

If homeowners could choose to service their loan for themselves for free, or pay the .25% servicing fee to have one of our big bank or non-bank servicers do it for them, how many would still pay the fee? How about once the homeowners learn that servicing their own loan requires no extra work from them?

Half a Blog Post, on Silver, and rwhadvisory LLC

It is about ten minutes after eight and I am at the store. Last night as I was loading inventory I listened to the most recent MacroVoices podcast featuring guest Ronald Stoferle. They covered many topics of interests, and the entire pod is worth a listen, as Erik’s always are. Check it out here: https://www.podbean.com/ew/pb-9q83q-de0932 . But the comments about silver had me checking in on the trade. I hadn’t been watching the silver trade very closely. Since I last wrote about silver on April 27, here, http://rwhadvisoryllc.com/silver-update-the-world-silver-survey/ when the closing spot price was $15.15 the metal is up 22% ending May at $18.49. Looks like it has taken a dive again so far in June, currently trading at about $17.99 as I write. Silver will continue to be an interesting part of the macro and monetary story, I believe. My take-aways? In the World Silver Survey the authors talk about and average silver price for the year of about $15.70 and a peak price of about $19. I would say so far their thesis is intact. Secondly, experts often talk about silver as gold’s volatile cousin, or sibling, or similar. I think in the MacroVoices pod I reference about the guest refers to silver as ‘gold on steriods’. During approximately the same time period (month of May) gold was up about 1.7%. I find May illustrates silver’s relative volatility.

Since I have my resale business, I continue to accumulate physical silver, but have not revisited a trade. I still have exposure to silver through my CDE trade (if you missed it you can read about it here: http://rwhadvisoryllc.com/one-of-the-days-in-quarantine/ . I am comfortable to continue in that fashion, as far as silver goes.

I have much, much more to write since last publishing. Coming topics will include:

- Writing my own shitcoin on the Ethereum network

- Orchid VPN

- CA AB 2501 and reason # 47 on why MSRs are a liability, not an asset

- Securitization of personal property and collectibles, or tokenizing them (ah…a peak at some of the thinking that went into launching Good Find Stores?)

So, getting this half-blog posted now and will return soon with these other topics.

Final thought: I had a former friend and colleague reach out to me the other day. She had seen my work anniversary notification on LinkedIn, and checked my profile. We haven’t spoken in about five years. She asked “Looks like you are consulting and doing retail?!” The way I would say what I am doing is: I am building and buying businesses that interest me, and align with my long-term macro thesis and providing business planning, management and operations services, but only in exchange for equity-based compensation. But yeah, if you took a snapshot, I am totally doing consulting and retail. Specifically resale retail, which is an important distinction.

Residential Mortgage Loan Servicing Deep Thoughts #1

Why does a KYC banking customer with a non-escrowed, government-backed loan, who pays their taxes, have to pay a loan servicing fee as part of their interest rate?

Oil Wasn’t the Only Asset That Went to Zero in March

It isn’t exactly news, since the Ocwen (OCN) earnings call was held on May 8th, but I was only just able to make my rounds through recordings for mortgage cos this past week for those I follow. One of my favorite highlights from the calls is Glen Messina, CEO talking about current margins and the ‘cash cost of servicing’. It is at about minute 36:00 if you want to listen to it here: https://edge.media-server.com/mmc/p/nx2pnfmv Here is a transcript of the relevant part:

“In terms of the profitability of new servicing, look, margins in the origination environment we’re in today are at levels few of us have seen in our lifetime. It’s a very robust originations market, both from a volume and a margin perspective. In our portfolio retention channel, the economics are such that fundamentally, MSRs — the cash cost of the MSR is zero. So we are — that MSR has come back — coming back to us without necessarily a cash investment. And margins and correspondent lending, again, are as wide as — and our flow channel’s wide as we’ve seen them in quite a long time. So the cash cost, so to speak, of MSR creation is well below the fair value. There’s a number of dislocations in the market, as you might be able to suspect, that’s kind of driving that. But the returns on MSRs today are some of the best we’ve seen.”

Now, one of my recurring themes I will write about a lot is that servicing rights have no value, and are a liability, not an asset. To be clear, there is a big difference between what Glen is saying when he says servicing rights are worth zero, and what I mean when I say it. What Glen is talking about is that the amount of cash he can get from the government for just the mortgage loan, without selling them the servicing right, is the same or more than he can get in private transactions for both of those things together. What I am saying when I talk about servicing rights not having value and not being a real asset is that fundamentally, I don’t think the activities that comprise residential loan servicing have value, and in fact, have negative value across consumer, mortgage banker and bondholder, serving no one and yet being called servicing. Glen’s comments delight me anyway because, well maybe we are sort of saying the same thing. I can remember in 2008 when servicing also ‘went to zero’, in the Glen sense. I seem to recall a lot of residential housing stock transferred from owner-occupied to investor-owned following that. (checks watch).

Other things that stuck out as general observations to think about:

Change in carry-back rules under the CARES Act. Seem lucrative, won’t help the federal debt any. Doesn’t do much for the folks paying the servicing fee. Why can’t individuals access their own, previously paid taxes in years when their income declines? Think how that might change behavior, and leave a (thoughtful) comment.

PennyMac (PFSI) is an overachiever. At hedging.

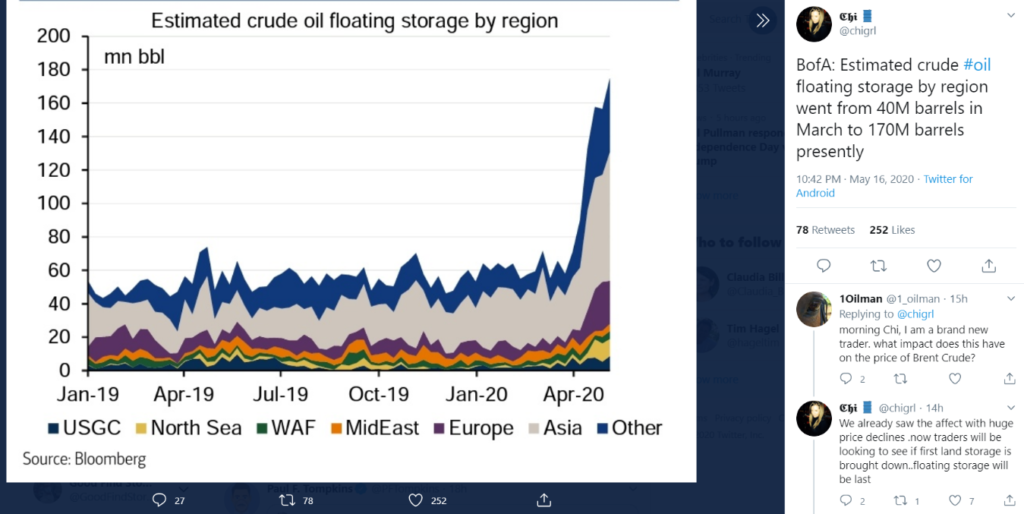

Updating on the oil tanker trade, we had earnings and…yeah. Not too exciting. I think last week we speculated that the air was out of the trade and it seems there is confirmation. That was anticlimactic. Anyway, I have FRO through June expiry and NAT all the way to October so we shall see. I have not had opportunity to really get into a post mortem on the trade but I think what we are seeing is the same phenomenon as the futures prices for oil: another sign post saying “not a V” . This tweet from @Chigirl sums it up for me:

Finally, I will confess my failed Tilray (TLRY) trade. It was pure speculation that earnings could surprise to the upside and make the shorts feel awkward. Another air biscuit. Option premium to the gambling Gods.

Teaser to keep you coming back: I am working on a product review for a VPN service provider, Orchid, which operates on a token called OXT. My effort at diving into to the incredible ecosystem of businesses and services in the crypto space. And we’ll be taking a harder look at some residential mortgage servicing stuff.

And, for your final take-away, @PeterMcCormack has produced a ton of great #bitcoin related content, including compressing his comprehensive, 17-part series on What Bitcoin Did into a paltry hour-twenty or so minutes. It can be found here:

https://www.whatbitcoindid.com/podcast/bitcoin-in-one-lesson

Antepenultimate Day, aka Sunday

It is about ten minutes after four on Sunday, and I am at the store. I have a few thoughts to add to my blog ahead of penultimate day tomorrow on the May crude oil contract, so that is why I am here, roused to action after my nearly two days of torpor.

As we round the corner into the May oil contract expiry, the consensus appears to be that settlements will be more orderly and there will not be a repeat of last month’s eye-popping negative oil prices. My trades for on-the-water storage have retraced, but I still have conviction. Regardless of an orderly match-up tomorrow and Tuesday between paper and physical, storage on the water looks to me like it is going to be around for a while, and the tanker companies still look positioned to print money from it for a good little bit. My trades last until the October expiry for NAT, so I don’t need to worry if nothing exciting happens with May deliveries. For my FRO trade, I am good through June and can look ahead to Q1 earnings and estimates as a catalyst, currently scheduled for May 21st.

There have been a number of signposts along the way to help me get conviction that the storage trade will play out, including this one I just saw from @chigrl:

There has been plenty of additional discovery in support of the trade and it does leave me a little baffled that the tankers aren’t already doing better. Here is an interview with Frontline CEO Robert Macleod:

https://megaphone.link/SA6350053602

I found it informative, and the three things I took away were 1) I think he actually kind of giggled, at one point, when talking about the charter rates they would be reporting when he is allowed to disclose earnings, 2) charter terms are extending, which I felt might explain the leg down we saw in charter prices, and 3) he acknowledges that there will be a pendulum swing in the other direction, sometime early next year, when tankers have offloaded to land storage, but supplies are still excessive causing a dearth in shipping and significant excess capacity. In a world where you think the market is a forward-looking discounting mechanism, like they taught me to say in college, you might think this third point could explain the retrace in my tanker trade. As I said though, I retain conviction.

I am compelled to add this link, which I was listening to AS I WRITE. I just click-holed through to it and have never heard this person before, but I had literally written “I retain conviction” at about the 19:30 point in this podcast (see about minute 24:30ish), and I also love that he trashed on Nordic American (NAT) which was my exact trade last month (which I made very much on the fly without real research). Also appreciated his comments on the relationship between equity and debt. Agree with his position that equity benefits when debt is retired. Debt holders are betting against equity. They are enemies, IMO, from an incentive standpoint. Anyway, appreciated his thinking and delivery, so following him @JohnPolomny to learn more. Final note: disagree with the diminutive euphemism he uses for the global health crisis.

One last thing to mention, not so much because I think it impacts this specific trade, but certainly I think it is an important development in the macro-trade: these tankers from Iran going to Venezuela.

I am haunted by the sense of theater I feel behind the actions of pretty much all participants. I don’t think it leads to solutions. Not solutions with a Nash equilibrium, anyway. More like the solutions you get in the school yard when the grownups aren’t looking.

Oil Tanker Trade Update

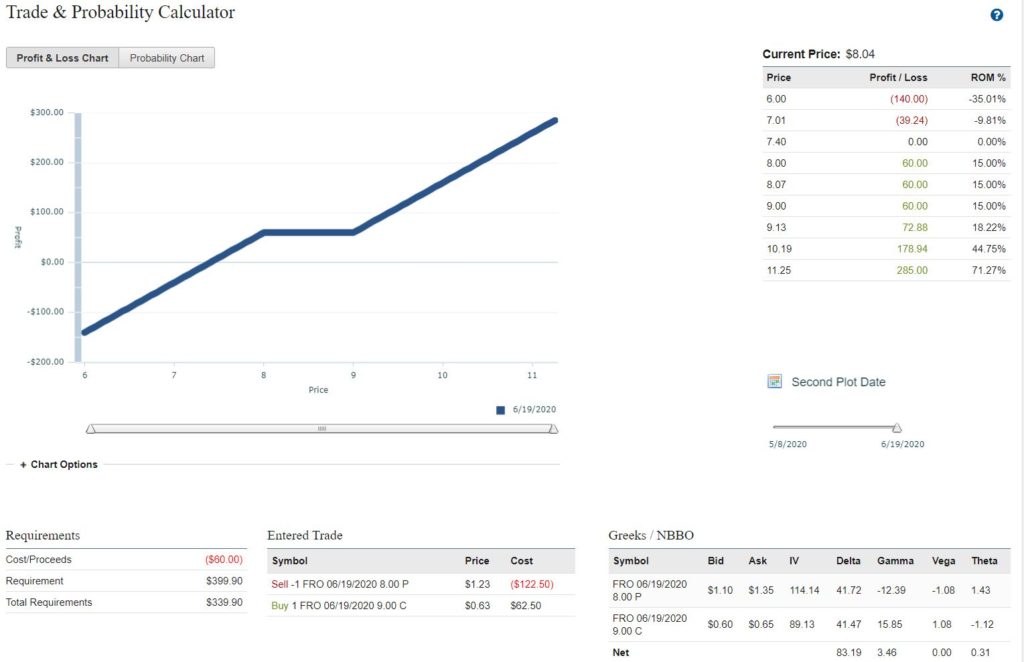

Is it time to double down on the oil storage super contango bet? I have been doing my market and macro reading and listened to the MacroVoices update on oil contango and the storage crisis. My NAT options have retraced to $1.25. These are October 2020 expiry with a $5.50 strike. Currently up 100%, but that represents a very significant retrace from the high, and the options are still twice as costly as when I bought them. My polestar on matters oil, Erik Townsend at www.macrovoices.com, has just acknowledged evidence to support the storage crisis may have abated, due to aggressive well shut-ins and capacity created by decreased tanker spot market activity coming out of the Middle East. The May contact expiry is next Thursday, with last trading day on Tuesday the week following. It is a short time to have exposure, and the time spreads have narrowed significantly. I think it is worth a little more exposure to the possibility that the markets are bluffing on storage capacity. I have looked around at some other tanker cos, and I am decided to go long Frontline (FRO). Here is my trade, which will see me past the Q1 earnings release on May 21st. I feel pretty confident that they will be reporting some pretty eye-popping numbers from oil on water storage:

It will be an interesting stretch of time with the coming expiry of May oil contracts, and then the Q1 earnings. Time will tell. I’m excited to learn.

PennyMac Earnings For Breakfast

It is still May 6th, and I am still at the store. It is now about twenty minutes before seven in the evening. I want to write a few words about PennyMac and earnings tomorrow. Obviously, with my history with PennyMac and its management, my views on the company are plagued by biases. Those biases suggest the company operates at a constant deficit in human and intellectual capital which will impede even a successful strategy. And my assessment of the company’s strategy is basically this: PennyMac is not a company built to last. It is a company built on the oldest models for the purpose of exploiting the institutionalized business of mortgage banking. It exists to profit to the very fullest extent possible before the inevitable collapse of the current, anachronistic (and I would add anti-competitive, socialized risk) model of the industry. I don’t judge that as a wrong-headed thing to do. In fact, it cannot be argued against, if one looks at the financial performance of the company so far. I am saying the company is purpose-built, and that purpose is not to lead an industry into the future, but to seek the available excess rents while they exist. While one can chalk up my views of management to the bitterness of a failed work assignment, I think this strategy assessment stands up to scrutiny. If one considers the start of the company, where its money came from, what other business interests that same money had and has in and around the same industry ecosystem, who the leadership team is and what their backgrounds are, I think there is a good argument to say I am right. Time permitting, I will expound more on these questions of origin and interests.

PennyMac’s planned obsolescence is not its only weakness at this point in time and this point in the economic cycle. Or perhaps even because of its mission, it is concentrated in businesses I think are especially vulnerable to sudden disruption, by intervention or by market forces. Specifically, I am talking about correspondent lending and residential mortgage loan servicing. I view these as obviously fragile businesses that are capital intensive and valueless. Again, I will certainly be expounding on these subjects in more detail in the future. Add to these the latest developments in credit risk securities esoterica, financed with leverage, of course, and gorged on by PennyMac and I just could not be more bearish.

Still, is it enough to have conviction for a trade? No. I just don’t have enough insight to say what the trade will be for tomorrow’s earnings. I am on the sidelines, eager for a look at whatever the public docs say and don’t say. Even if I thought I had insight into financial under performance, in this climate of Fed intervention, I’m not sure it would matter. Everyone is getting a bailout if they are big enough to have lobbyists. And PennyMac minds its Washington connections.

If I could share one tradable insight, it would be this: During the first quarter founding partners of the company, acting in coordination with it, took actions as disclosed in published 8-Ks, to dis-invest about 35% of the company’s equity, transferring it to public float. People will argue that these sorts of actions get planned well in advance, and many features of the economic landscape could not have been known by the investors and management at the time the decisions were being made. My point would be that it doesn’t matter. The founders had an exit planned when they went in, and they are beginning to exit. They may be very happy/lucky that they transferred their ownership and its attendant risks to the public just as the markets were about to collapse (and arguably, just as the old model of the mortgage industry is about to disappear). Maybe it is just good fortune. But keep in mind, many sophisticated investors have been aware of the potential impacts of the coronavirus since December, or possibly November of last year. This is doubly true for investors who are well connected politically or who have global financial interests. Even putting all of the pandemic to one side, as though it never had happened, the macro-climate was already in serious distress. Fed interventions have pre-dated the coronavirus by many months. I can easily imagine that the founding investors saw the sun setting on the business model and started to execute their planned exit well before the virus. It was just time.

I don’t know how bad tomorrow’s results will be, or maybe even they will be good. But the rats are leaving the ship. It won’t be staying afloat for long.

Parting gift: another #bitcoin meme that made me laugh over and over… https://twitter.com/i/status/1258070598225408001

Silver Update, the World Silver Survey

I am posting this short entry tonight to follow up on my posts about silver back on April 1st and 17th. I continue to survey the market looking for conviction on a silver trade. That conviction has manifested in the Coeur Mining trade I detailed, but so far nothing else. The CDE spread was performing well heading into the earnings call. On the call the CFO identified an approximately $10 million hit to free cash flow coming out of the company’s Mexico properties due to the covid-19 related shut-down. I personally listened to the call and was encouraged, but the market did not receive the call so well and the stock price is not back to a very similar level, around $3.60, to where it was when I put on the spread. With that in mind, it is my policy to double down on an unexpired investment thesis if the market presents an opportunity, so I am considering it. I am considering it with a strong lean away; I would like to find a different approach to any upside in silver, if I can get conviction, before revisiting my current trade.

But the reason I am writing tonight is because, during the month of April (and in fact it looks like just a day or two ago) the Silver Institute and Metals Focus have published their annual World Silver Survey, which can be found here: https://www.silverinstitute.org/all-world-silver-surveys/ . Anyone interested enough to be reading this post should be interested enough to read the report, but the take-aways for me were:

- Excess inventories,

- Covid-19 related disruptions across the supply and demand spectrum making projections difficult, and I would characterize Metals Focus’ estimates both on the impact to extraction and to industrial demand as far too conservatively low in magnitude,

- Average 2020 price projected to be a meager $15.70, peak price target of $19,

Overall, I did not find the report particularly bullish for silver in the next 12 months. Time will tell. I would love to hear your key take-away from the World Silver Survey. Leave your comments below!