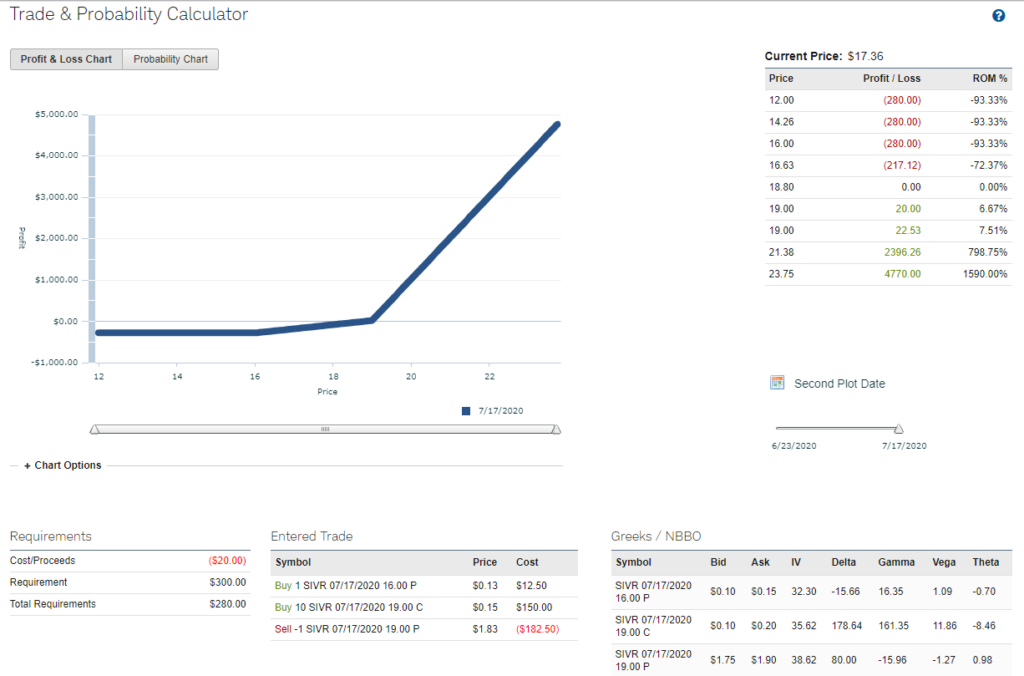

It is about twenty minutes after eight in the evening, and I am at the store. This morning while doing my financial markets reading, I was caught up in the animal spirits. I made my usual, daily entry in the record books that the market is stupid; it was another nice up day, of course, because now those are the only kind. And I read a few pump articles on Seeking Alpha about one of my favorite subjects: silver. Gold looks like it is trying to push and stay higher. Like I said, animal spirits. So I have made a little wager on the potential for a silver rally between now and July expiry. Here is (approximately) the trade:

I have a real hate for this market, and see many areas of weakness that beg for shorting, but with interventionism and the potential for truly major currency issues, this small, short-time frame bet in a familiar category was all the more animal spirit I could muster. And for the record, I only did this trade 2X, so sold 2 of the puts, etc. Come July expiry, if it has not paid off, I will seriously consider rolling the trade, just because I think this is a thing that is going to happen.

What sort of dynamics might the turbulence of the current climate cause in the silver markets? If there truly is a ‘V’ recovery, and industrial demand for silver recovers to pre-covid levels, will there be a supply crunch due to mining interruptions? What if industrial demand does not recover? Glut, and price crash? Could consumer demand off-set significant decreased industrial demand? Will silver ever have a place on the currency, collateral or savings technology spectrum again? Will we have major, state-sponsored infrastructure and industrial spending initiatives as a part of this cycle, which will fuel demand for silver in the longer term? Most of these questions can’t be answered within my option period, but silver continues to feature in my thoughts for its potential.