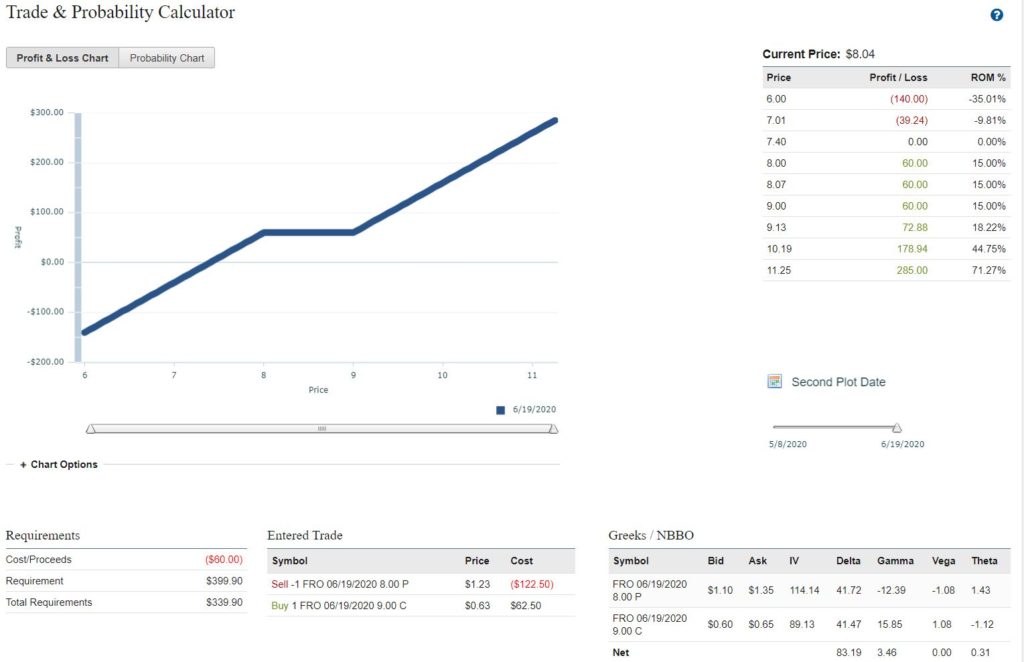

Is it time to double down on the oil storage super contango bet? I have been doing my market and macro reading and listened to the MacroVoices update on oil contango and the storage crisis. My NAT options have retraced to $1.25. These are October 2020 expiry with a $5.50 strike. Currently up 100%, but that represents a very significant retrace from the high, and the options are still twice as costly as when I bought them. My polestar on matters oil, Erik Townsend at www.macrovoices.com, has just acknowledged evidence to support the storage crisis may have abated, due to aggressive well shut-ins and capacity created by decreased tanker spot market activity coming out of the Middle East. The May contact expiry is next Thursday, with last trading day on Tuesday the week following. It is a short time to have exposure, and the time spreads have narrowed significantly. I think it is worth a little more exposure to the possibility that the markets are bluffing on storage capacity. I have looked around at some other tanker cos, and I am decided to go long Frontline (FRO). Here is my trade, which will see me past the Q1 earnings release on May 21st. I feel pretty confident that they will be reporting some pretty eye-popping numbers from oil on water storage:

It will be an interesting stretch of time with the coming expiry of May oil contracts, and then the Q1 earnings. Time will tell. I’m excited to learn.