It is about ten minutes after four on Sunday, and I am at the store. I have a few thoughts to add to my blog ahead of penultimate day tomorrow on the May crude oil contract, so that is why I am here, roused to action after my nearly two days of torpor.

As we round the corner into the May oil contract expiry, the consensus appears to be that settlements will be more orderly and there will not be a repeat of last month’s eye-popping negative oil prices. My trades for on-the-water storage have retraced, but I still have conviction. Regardless of an orderly match-up tomorrow and Tuesday between paper and physical, storage on the water looks to me like it is going to be around for a while, and the tanker companies still look positioned to print money from it for a good little bit. My trades last until the October expiry for NAT, so I don’t need to worry if nothing exciting happens with May deliveries. For my FRO trade, I am good through June and can look ahead to Q1 earnings and estimates as a catalyst, currently scheduled for May 21st.

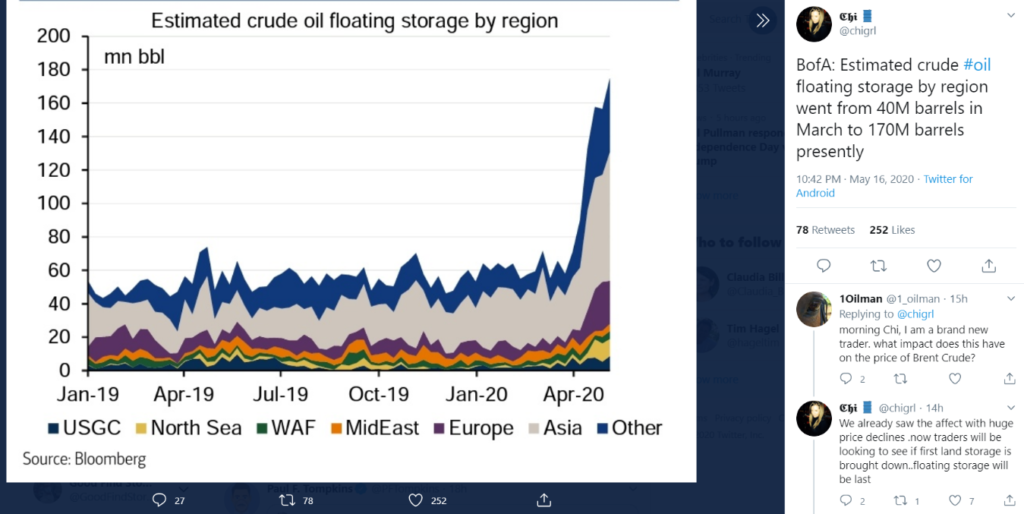

There have been a number of signposts along the way to help me get conviction that the storage trade will play out, including this one I just saw from @chigrl:

There has been plenty of additional discovery in support of the trade and it does leave me a little baffled that the tankers aren’t already doing better. Here is an interview with Frontline CEO Robert Macleod:

https://megaphone.link/SA6350053602

I found it informative, and the three things I took away were 1) I think he actually kind of giggled, at one point, when talking about the charter rates they would be reporting when he is allowed to disclose earnings, 2) charter terms are extending, which I felt might explain the leg down we saw in charter prices, and 3) he acknowledges that there will be a pendulum swing in the other direction, sometime early next year, when tankers have offloaded to land storage, but supplies are still excessive causing a dearth in shipping and significant excess capacity. In a world where you think the market is a forward-looking discounting mechanism, like they taught me to say in college, you might think this third point could explain the retrace in my tanker trade. As I said though, I retain conviction.

I am compelled to add this link, which I was listening to AS I WRITE. I just click-holed through to it and have never heard this person before, but I had literally written “I retain conviction” at about the 19:30 point in this podcast (see about minute 24:30ish), and I also love that he trashed on Nordic American (NAT) which was my exact trade last month (which I made very much on the fly without real research). Also appreciated his comments on the relationship between equity and debt. Agree with his position that equity benefits when debt is retired. Debt holders are betting against equity. They are enemies, IMO, from an incentive standpoint. Anyway, appreciated his thinking and delivery, so following him @JohnPolomny to learn more. Final note: disagree with the diminutive euphemism he uses for the global health crisis.

One last thing to mention, not so much because I think it impacts this specific trade, but certainly I think it is an important development in the macro-trade: these tankers from Iran going to Venezuela.

I am haunted by the sense of theater I feel behind the actions of pretty much all participants. I don’t think it leads to solutions. Not solutions with a Nash equilibrium, anyway. More like the solutions you get in the school yard when the grownups aren’t looking.